Global water heating market shifts gear

|

| Article written by George Laganas |

[edit] Renewables Surge, Traditional Systems Sputter

The current energy crisis has added pressure on governments to accelerate their green initiatives in space and water heating technologies. It will therefore come as no surprise that our analysis of the global water heating markets found that heat pumps, electric storage, and instantaneous water heaters recorded the biggest growth in 2023 and the forecasted period.

2023 saw traditional water heating systems grow by 1.5% globally, whereas water heaters powered by renewable sources (i.e. heat pump water heaters) reported an impressive growth of 21.3% (vs 2022). Our analysis showed that end-users are increasingly replacing gas systems with electricity storage or instantaneous units, given the ever-growing spark gap in most economies. Oil-fuelled water heaters are declining, as they are banned from most markets, with some exceptions for remote areas off the gas grid. Nonetheless, there are certain countries that still permit oil water heaters, but they do so under the condition that a renewable source of heating works alongside them; hence ensuring partial sustainable output.

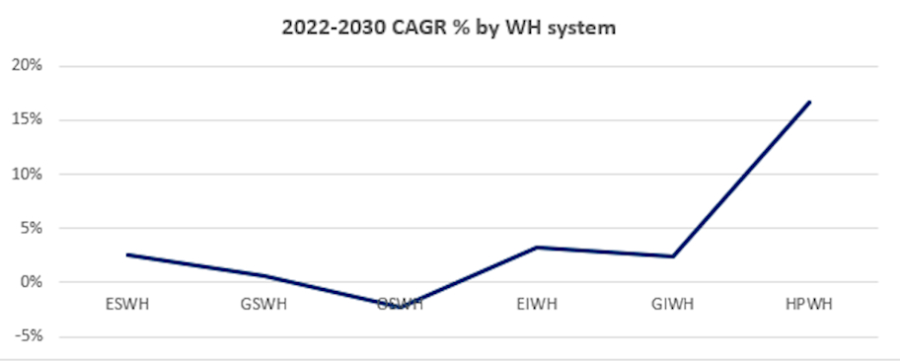

The above graph depicts the CAGR % for each water heating system from 2022 to 2030. Besides oil-fuelled systems that are in decline, gas storage water heaters note the lowest growth (below 1%). Middle East and Africa still rely on these types of systems, so slight growth is seen in this region. Electric storage water heaters also note a CAGR of 4.5%. However, in Europe gas storage systems are forecasted to decline by almost 5% by 2030 and electric storage water heaters note a marginal growth of 1.3%, for the same period.

Instantaneous water heating systems show a different global picture. In all researched regions, we found that electric instantaneous water heating systems are growing at a faster rate than gas instantaneous systems. The Americas show a 3.3% CAGR (2022-2030) for EIWH and 2.1% for GIWH. Europe’s CAGR for EIWH is marked at 2.7% yet GIWH are in decline with CAGR -2.9% for the same period.

Heat pump water heaters note the biggest potential globally, with almost 17% CAGR for the period 2022-2030. The Americas and Asia & Oceania hold the biggest participation in this market, with over 20% CAGR, whilst Europe notes a 12% CAGR, albeit representing the most advanced market worldwide when it comes to renewables and sustainable sources of energy. Middle East & Africa are not regions we find heat pumps established, as they still rely on traditional systems to heat space and water.

Solar-Thermal water heating saw a slight growth in 2023 versus 2022; however, the future outlook seems much more promising with an overall CAGR 2022-2030 at 3%. Middle East & Africa are the regions that invest the most in ST systems, benefitting from the local climate.

This article appears on the BSRIA news and blog site as 'Global Water Heating Market Shifts Gear: Renewables Surge, Traditional Systems Sputter' dated January 2024 and was written by George Laganas.

--BSRIA

[edit] Related articles on Designing Buildings

- Aaron Gillich, Professor of Building Decarbonisation and Director of the BSRIA LSBU Net Zero Building Centre.

- Building services.

- BSRIA seminar on knowledge to achieve a net zero future. March 2023

- BSRIA topic guide to thermal comfort TG22 / 2023. February 2023

- Combustion plant.

- Heat pump.

- Heat pumps and heat waves: How overheating complicates ending gas in the UK.

- Heating controls.

- Heating large spaces.

- Heating.

- Hot water.

- Hot water safety.

- HVAC.

- Low carbon heating and cooling.

- Net zero building centre with BSRIA and LSBU.

- Pipework.

- Radiant heating.

- Radiator.

- Rules of Thumb - Guidelines for building services.

- Thermostat.

- Types of heating system.

- US water heating market update 2021.

- Water heating.

Featured articles and news

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure bill oulined

With reactions from IHBC and others on its potential impacts.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

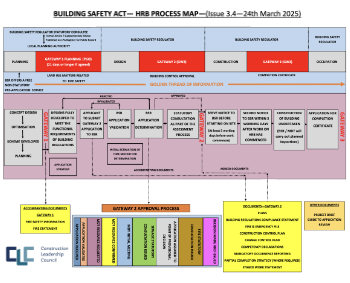

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.